* With sufficiently large and entrenched companies.

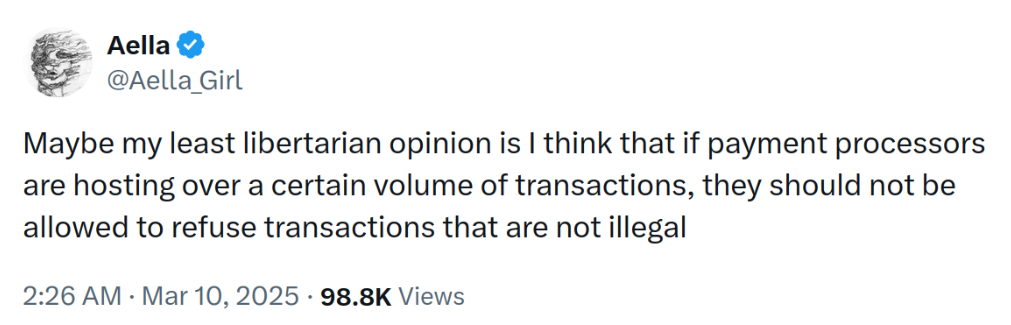

There's a semi-common meme on Twitter where people share their most X opinion, where X is a group the poster doesn't identify with11; or sometimes my least X opinion, where X is a group they do identify with.

In that spirit, my least libertarian opinion is that exclusivity deals with sufficiently entrenched companies1 are bad and should be illegal2.

To make it even less libertarian, I think it should be an unfair playing field and their competitors should be allowed to pay for exclusivity3. If you're a new entrant to a market, an exclusivity deal might be the only way you can break in, and more competition is good4.

Exclusivity Deals With Monopolists Have Asymmetric Costs

The problem with exclusivity deals with a company that already has a monopoly is that the cost is much higher for a new entrant than the monopolist.

I hunted down some stats for market share13 and some royalty rates for the top platforms14:

| Platform | Market Share | Normal Royalty | Exclusive Royalty |

| Audible | 63% | 25% | 40% |

| Apple5 | 18% | 25%5 | 40%5 |

| 10% | 52% | 52% | |

| Other | 8% | Up to 50% | N/A |

Note that you can get Audible's exclusive rate by being exclusive to ACX156, an Audible-owned company which also distributes to Apple and Amazon.

Your Choices

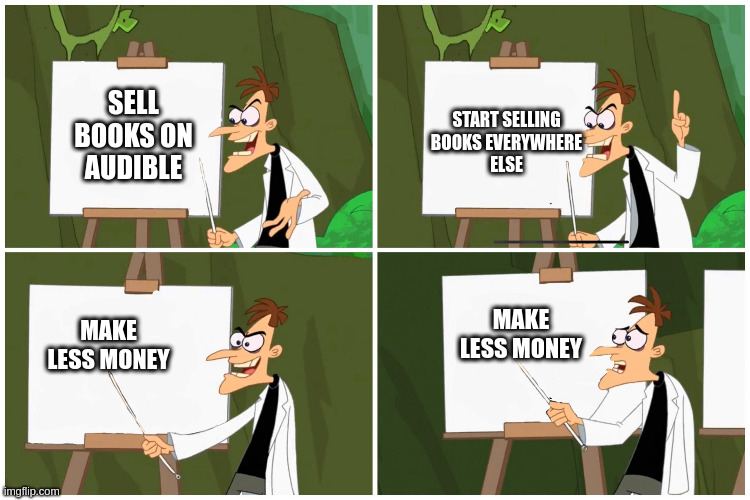

So, say you want to sell $10,000 worth of audiobook to a market where customers are 100% loyal to the platforms they used in 202113. Your choices are:

| Strategy | Average Royalty Rate | Market Access | Total Income |

| ACX Exclusive | 40% | 81% | $3,240 |

| ACX + Google | 28% | 91% | $2,545 |

| ACX + Everywhere | 30%7 | 100% | $2,995 |

So the choice for users of this market is:

- Do the easy thing and publish with the monopolist.

- Do a ton of work using multiple distributors and make 8% less.

Note that the non-monopolists are already paying 10% more than the monopolist's exclusive rate! To break even, the last 19% of the market would need to offer an average royalty rate of 64%. For a company like Google to offer a worthwhile exclusivity deal, they would need to offer a royalty rate of 324%8.16

This Seems Bad

The idea behind free-markets is that on a fair playing field9, businesses will compete to provide the best deal. Any company that provides a bad deal will be out-competed by someone else. Unfortunately, this depends on sellers being able to compete on costs, and exclusivity deals don't have that property: It costs Audible significantly less to buy exclusivity than it costs their competitors, in ways that their competitors can't compete with, even in theory10.

So, I think we should ban it.

I have a truly marvelous definition of a sufficiently entrenched company which this margin is too narrow to contain. ↩

I propose the Abolishing Uncompetitive Distribution Imposing Barriers and Licensing Exclusivity Act. ↩

If you think I'm making this case too strongly, please argue against it. I would be so owned16 if someone forced me to have completely consistent libertarian beliefs with no cognitive dissonance. ↩

Citation needed. ↩

Apple allegedly pays 70%, but you can't publish with them directly and have to use a publisher like ACX which keeps most of your earnings17. ↩↩↩

A company owned by Audible18. ↩

Optimistically assuming 50% royalty rates for the long tail. ↩

Ok, so this might be too strong, since some people will switch platforms to listen to an audiobook, but I expect you're not going to get enough people to switch to bring this rate below 100%. ↩

Where everyone has their private property protected by the police and contract law. ↩

You might assume from this that I support a much more general form of anti-monopoly law. I don't want to argue against it here, but I'll just note that I'm not convinced that bigger companies are automatically more efficient19, and markets in monopolized physical resources encourage technological advancement20. ↩

https://x.com/mnolangray/status/1877584046575722661

https://x.com/Aella_Girl/status/1899029178856710572

https://www.enterpriseappstoday.com/news/audiobook-market-statistics-non-fiction-has-the-largest-share-of-revenue-of-65-in-2022-according-to-market-us.html#Audiobook_Statistics_by_Platform - "Audiobook Market Statistics – Non-Fiction has the largest share of revenue of 65% in 2022 | According To Market.us - Enterprise Apps Today"

https://danieljtortora.com/blog/best-audiobook-platform-for-authors - "Best Audiobook Distribution Platforms: Where to Publish Audiobooks"

https://blog.reedsy.com/guide/audiobooks/distribution/#audiobook_distribution_through_acx__higher_royalties_on_audible - "The Ultimate Guide to Audiobook Distribution"

https://x.com/DanielleFong/status/1954631613431832899

https://danieljtortora.com/blog/acx-audiobook-royalties-get-paid - "ACX Audiobook Royalties: How Much Do You Get Paid?"

https://en.wikipedia.org/wiki/Audiobook_Creation_Exchange - "Wikipedia: Audiobook Creation Exchange"

https://www.lesswrong.com/w/moral-mazes - "Moral Mazes — LessWrong"

https://en.wikipedia.org/wiki/Synthetic_diamond - "Wikipedia: Synthetic diamond"